How & when VAT is applied for your placements

It is crucial that we have the correct VAT number for all contractors, where applicable, but understand this isn’t always available at the time the placement is added.

This guide details what happens with VAT within a Sonovate facility.

- What happens if Sonovate don’t have a VAT number?

- Where to see where VAT has been paid on the portal

- Where to add VAT numbers

- What happens with International Candidates

- How to add your Agency VAT number to the Sonovate Portal

- How can candidates add VAT for expenses via online timesheets?

What happens if Sonovate don’t have a VAT number?

Since Sonovate advance at 100% (less fees) then if the VAT number is missing then the VAT amount of 20% will automatically be paid into the weekly margin.

If the VAT number is received at a later date then we will raise VAT only invoices which will need to be paid to the contractor directly by you. This is because the funds have already been paid to you in margin payments in previous weeks.

As we do not withhold any funds against an invoice, it is not possible to prevent any payments from being made.

It is in the best interest of all parties that VAT numbers are input correctly from when the placement is originally added.

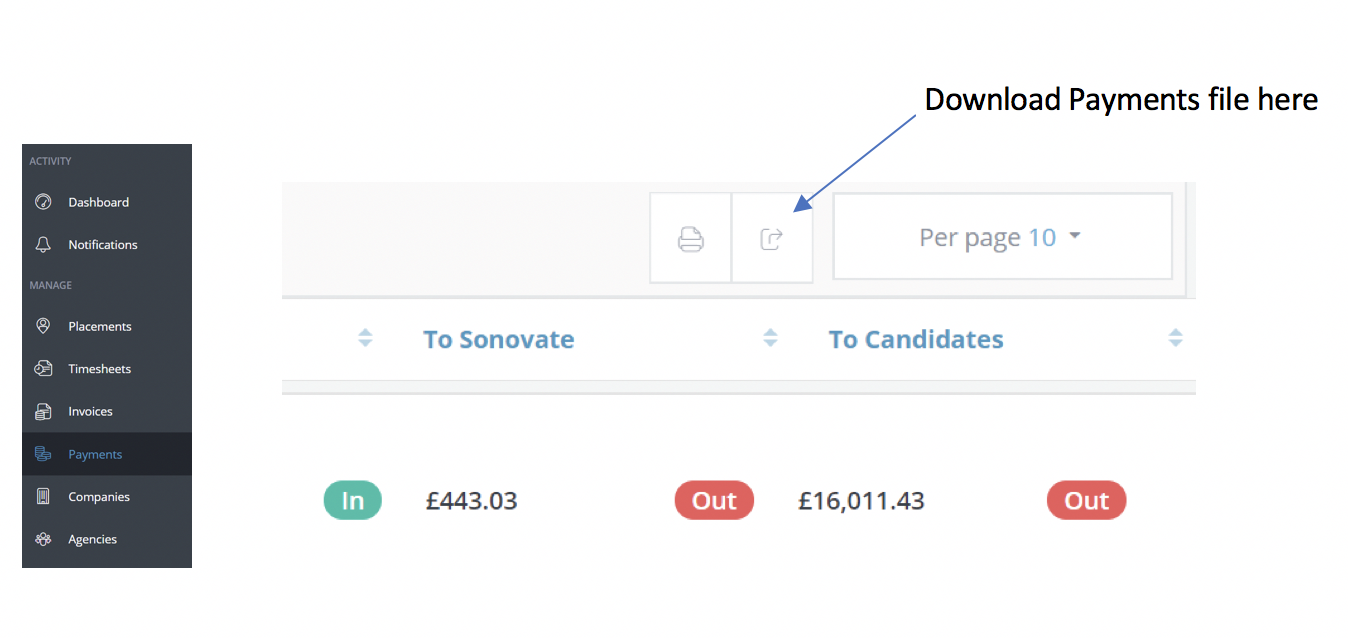

Where to see where VAT has been paid on the portal

The best place to see what has been paid is on the Payments section of the portal.

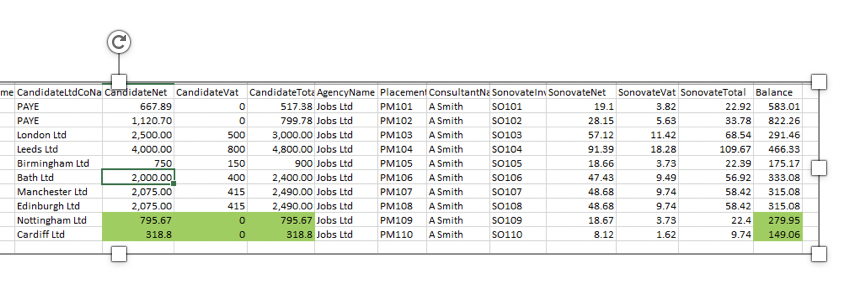

In the example below, in the highlighted cells, two candidates, Nottingham Ltd and Cardiff Ltd have not supplied VAT numbers (this could of course be correct) but the effect is that the balance paid in margin includes the VAT amount.

If the VAT number was later supplied then an amount of £159.13 would be owed by you to the candidate reducing the actual margin from £279.95 to £120.82 for that week.

Sonovate will create the adjusted VAT invoice and advise of the figure owed to the candidate. It will not show on the payments file even at a later date as the payment has already been included in margin as shown above.

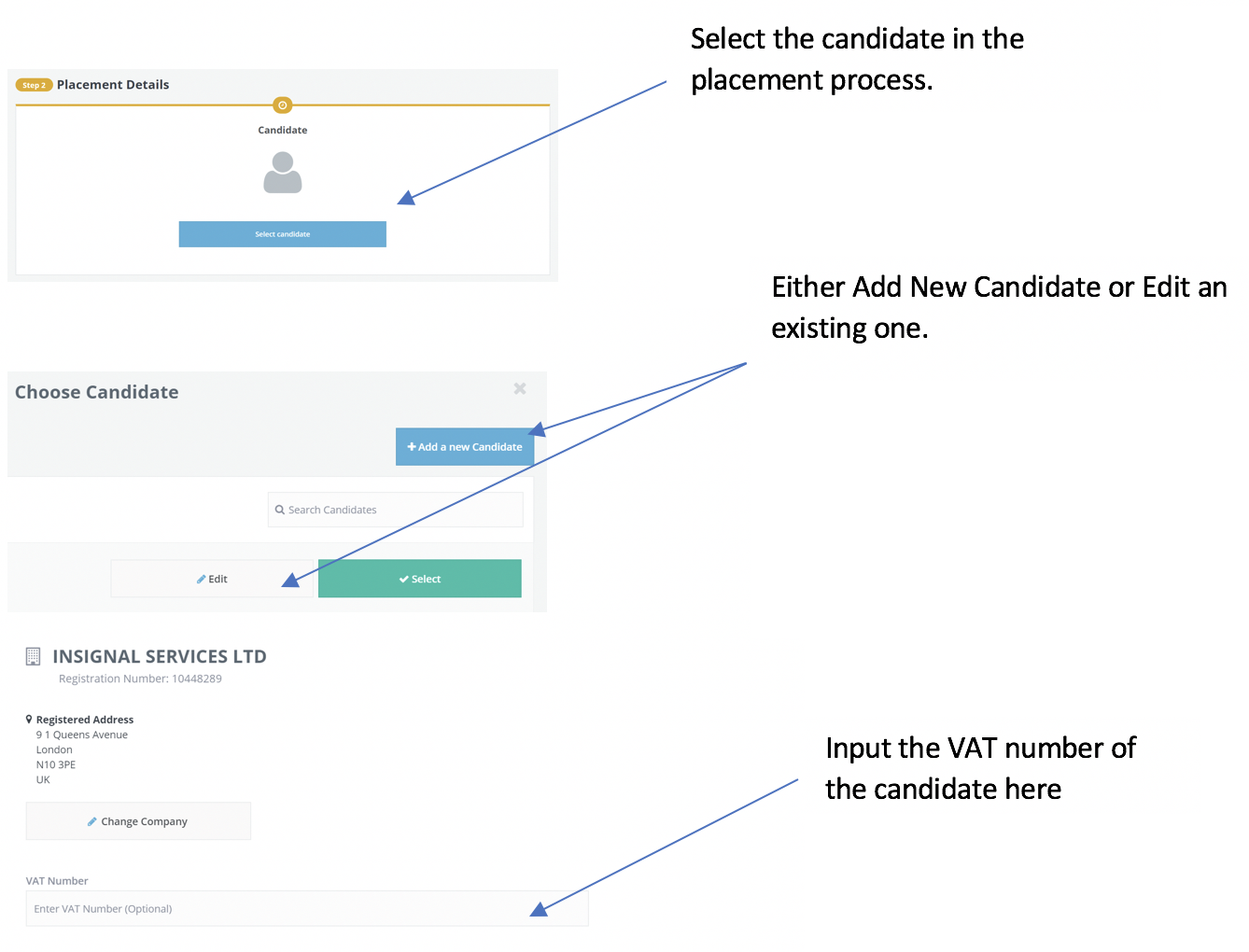

Where to add VAT numbers

Ideally, supplier VAT numbers are added when a placement is loaded to the portal.

It is not possible to add a VAT number at a later date for a live placement so please email the details into customerservices@sonovate.com

What happens with international candidates

Candidates working outside of the UK will not be subject to UK VAT law. This section needs to be left empty on the placement. In addition, no VAT will be charged when invoicing. This will be visible on the payments CSV download.

How to add your Agency VAT number to the Sonovate Portal

Your lead agency admin will be able to amend details of your agency in the Sonovate portal. If you are VAT registered, it is vital that you update us with your VAT number to prevent any payment issues in the future.

- Click on the 'Agency Admin' tab in the portal.

- You will see under 'Agency Profile' tab the details of your agency.

- Find VAT number, and click the

icon on the right of the tab.

icon on the right of the tab. - Enter your VAT number and click the

icon. This will then save on your Agency Profile.

icon. This will then save on your Agency Profile.

With your VAT number now provided, we will then be able to charge VAT to the end-client and make sure your margin payments are correct every week.

If you have any other questions on the matter, please contact us at customerservices@sonovate.com and one of our expert team members will be happy to help.

How can candidates add VAT to expenses via online timesheets?

How can candidates add VAT to expenses via online timesheets?

Candidates will need to calculate and add their VAT to expenses if and when applicable.

The video below is a guide on how contractors can add VAT to expenses. Feel free to share with them if they ever ask the question!

.png?height=120&name=sonovate%20logo%20copy-01%20(1).png)